Each year, the capital of China’s Xinjiang province, Urumqi, is host to one of two annually alternating exhibitions: the China Eurasia Expo or the Eurasia Commodity and Trade Expo.1In 2014, Chinese authorities decided the China Eurasia Expo would be held on even years, and the Eurasia Commodity and Trade Expo every odd year.

The sixth China Eurasia Expo2If expos before the alternating-years system are counted, that is. takes place 30 August to 1 September, 2018. The China Eurasia Expo “serves as an important platform for China to establish diplomatic relations with neighbouring countries, as well as a platform to build the Silk Road Economic Belt” (Zheng 2017). The Silk Road Economic Belt (SREB) is China’s effort to interlink with Central Asia, Russia, and Europe across the landmass of Eurasia. The articulate Bruno Maçães (2018) notes the choice of “economic belt” is deliberate. Belt implies “a densely occupied economic corridor for trade, industry, and people” (Maçães 2018).

At this year’s China Eurasia Expo, the Belt and Road Initiative (BRI) is the main topic of discussion (China Eurasia Expo 2018). The BRI is a Chinese-led infrastructure mega-project. The initiative’s aim is to coordinate maritime shipping lanes (the road) with overland transit infrastructure (the belt) from Asia to Europe. SREB is central to the land-based element of the BRI. The expo, then, is a chance to promote China’s relations with the countries of Eurasia, especially on the topic of facilitating trade and investment.

A shot taken in 2017 of the city of Urumqi (乌鲁木齐), in China’s Xinjiang Uygur Autonomous Region (新疆维吾尔自治区). Image Credit: Man21 / Wikimedia Commons / CC-BY-SA-3.0.

The range of delegates at the Eurasia Expos reflects China’s growing presence in the region. Eurasia is loosely defined as countries that have one foot in Europe and the other in Asia (Maçães 2018). These countries include Russia, Belarus, Ukraine, Moldova, Azerbaijan, Georgia, Armenia, Kazakhstan, Uzbekistan, Kyrgyzstan, Tajikistan, Turkmenistan, Afghanistan, and Pakistan. Practically all these countries have sent government or commercial delegates to previous China Eurasia Expos (MOFCOM 2011; 2014; CRI 2016).

As delegates from across Eurasia prepare for the coming 2018 expo, this post asks: how does China decide which regimes in Eurasia are worth developing relations with? Or, put another way, what is China’s approach to relations in Eurasia? Relations refers to any bilateral interaction between two states. The experience of interaction is the basis for a relationship. The more developed the relationship, the wider the range and the more sensitive the subjects for joint interaction can be. An approach to relations, then, is the process of determining which relationships have value and deserve the most attention.

This question is relevant, because the BRI, particularly the SREB element, is expanding China’s presence in Eurasia. Usually, attention on the region is split between East Europe and Central Asia. China’s new ambitions for Eurasia as a whole makes this split focus rather awkward. This suggests a holistic reappraisal of China’s approach to relations in the region is needed.

China’s approach to the Eurasia is based on security concerns held since the end of the Cold War. These concerns are defence of Chinese borders, securitisation of key resources, and access to markets and resources (Zhu 2010, 6; Heath 2012, 64). China’s approach to Eurasia can be identified via the official level of relations, various “partnerships” (伙伴), that correspond to these security concerns, which the Ministry of Foreign Affairs (MFA) assigns to regimes within the region. That is, certain empirical factors connected to China’s security concerns, such as shared borders, trade in strategic resources (petroleum, metals production, or agriculture), and bilateral infrastructure projects with China that facilitate trade, are reflected in the hierarchy of MFA partnerships. Partnerships are a symbolic indicator of the level of bilateral relations China has with a country. The hierarchy of MFA partnership levels, this post argues, indicates the importance regimes in Eurasia have for China. Thus, by understanding this hierarchy of partnerships and the conditions they require, it is possible to understand China’s approach to relations with the countries of Eurasia.

Outline

This post is a study in three parts. Part I, “China’s Partnership Relations,” is a description of China’s partnership relations. Part II, “Patterns of Partnership Relations in Eurasia,” presents the main argument and evidence for why the partnerships correspond to China’s security concerns. Part III, “A Hierarchy of Eurasian Relations” synthesizes parts I and II to construct a ranking of relationships reflected in China’s approach to Eurasia.

I. China’s Partnership Relations

The MFA assigns six different levels of relations for all foreign regimes.3A note on the translation of the various partnerships. The author used translations of the partnership types by David Cowhig (2017). Cowhig’s translations are clear and consistent. In order of least to most important, they are:

- Non-strategic partnerships (非战略伙伴关系)

- Strategic partnership (战略伙伴关系)

- Strategic cooperative partnership (战略合作伙伴关系)

- Comprehensive strategic partnership (全面战略伙伴关系)

- Comprehensive strategic cooperative partnership (全面战略合作伙伴关系)

- Special partnership and non-partnership relations (非伙伴关系)

Partnership (伙伴) implies a relationship of collaboration, joint undertakings, and shared risks (Su 2009, 35; Cheng and Wankun 2002, 238). Some scholars argue (Bang 2017, 380) that MFA partnership agreements are practically redundant. Countries also sign Economic Partnership Agreements with China, which contain the details of bilateral interaction. Nevertheless, countries still celebrate the award of partnership relations with China as major foreign policy achievements (Ibid.).

China’s partnership relations (伙伴关系) emerged in the mid-1990s. They are a post-Cold War approach to diplomacy. Partnerships are not alliances. Partnerships evolved out of China’s 1980s non-alignment model of relations, which do not have the military implications of alliances, but also allow China to have both peaceful and dynamic relations with other countries (Cheng and Wankun 2002, 240–244).

Essential to understanding China’s partnerships is their hierarchical structure (Dai 2016, 103; Cheng and Wankun 2002; Yeliseyev 2013). The different levels imply different expectations and significance to a bilateral relationship. Among the various types of Chinese partnership relations, “strategic partners” (战略伙伴) are “‘closer friends’ than other countries, and among the strategic partners, there is also an implicit hierarchical structure” (Feng and Huang 2014, 15). “Strategic” means there is some aspect of relations, which may impact defence of CHina’s borders, or supplies of strategic resources, or access to markets or additional resources.

Any partnership with “strategic” added to it tend to result in more developed relations with China. Countries increasingly make requests to Chinese diplomats to raise relations from non-strategic to strategic partnerships. More often than not, the MFA indulges these requests (Ibid., 9). This perhaps explains the growing number and type (from approximately 2011 onward) of strategic partnerships. All the same, the various levels among strategic partnerships prevent them from becoming frivolous.

Below is a characterisation of the six partnership types (ranked from least to most important) from the list above. The characterisations are partly informed y an article from a Hong Kong based newspaper, Wenwei Po (2015). The newspaper does not state the exact method used to determine the features of each partnership. It notes searching China Daily newspaper archives in order to fact check. However, the MFA website (MFA 2018) has country profiles, which clearly state the partnership China holds with a country. The profiles detail a short history of relations and the kind of interaction (trade, security interaction, agreements signed, etc…) China has with the country. The majority of profiles state the award date of the most recent partnership. It is likely this detailed resource was used to establish the characteristics and check facts of the various partnership relations. For this post, the MFA country profiles have been used (along with other sources discussed later) to verify claims of the Wenwei Po partnership list.

Type 1: Non-strategic partnerships (非战略伙伴关系)

When a partnership lacks the word “strategic,” this suggests the state has no special importance for political or security reasons, or as a source of strategic resources. This means the bilateral relationship is primarily economic.

Examples of non-strategic partnerships include all-round cooperative partnership relations (Belgium), comprehensive friendly cooperative relations (Romania, Bulgaria), comprehensive cooperative partnership relations (Ethiopia, Croatia, Nepal, Tanzania, Congo [Brazzaville], The Netherlands, and East Timor), friendly cooperative partnership relations (Azerbaijan, Georgia, Armenia, Moldova, and Senegal) and friendly partnership relations (Jamaica), and new, future-oriented cooperative relations (Finland).

Due to their importance for China’s security concerns, this post focuses on the levels of strategic partnerships.

Type 2: Strategic partnership (战略伙伴关系)

At the 2004 China-EU Investment and Trade Forum, Chinese Premier Wen Jiabao defined “strategic” being added to partnerships meaning “that the cooperation should be long-term and stable, bearing on the larger picture of… relations. It transcends the differences in ideology and social system and is not subjected to the impacts of individual events that occur from time to time” (Wen 2004).

In practice, a strategic partnership indicates that China’s interaction with a regime is growing. This means there is perhaps trade in a key resource or economic interaction with China, which warrants the deepening of ties. Newspaper Wenwei Po (2015) says this also signals to Chinese businesses they will receive government help to gain a foothold in the region.

The dozen or so countries with strategic partnerships include Kyrgyzstan, Turkmenistan, Ukraine, Canada, Nigeria, and other countries in South America, Central America, Africa, and Asia.

Type 3: Strategic cooperative partnership (战略合作伙伴关系)

Countries with these partnerships tend to be of geo-strategic significance. For example, they may either share a border with China or be located in China’s near abroad. They include countries that directly border on China, such as India, South Korea, and Afghanistan. Those that do not border China, such as Turkey and Sri Lanka, lie within what officials see as China’s near abroad. More recently, these states have fallen within the scope of the BRI.

It should be noted these partnerships do not contain the word “comprehensive,” which indicates the next, higher level of relations. The lack of this modifier means the scope strategic cooperation is not as broad. For example, although Afghanistan shares a common border with China, it is still preoccupied with civil war and there are deep domestic security concerns. Therefore the bilateral relationship focuses more on regional security and less on the economy, trade, and investment. But this is less becoming of Sri Lanka, for example, which is receiving ever greater sums of Chinese investment after the suppression of its civil war. Its partnership status with China may soon be raised to the level described directly below.

Type 4: Comprehensive strategic partnership (全面战略伙伴关系)

This form of partnership has been applied to the majority of recent (after 2011) upgrades in bilateral relations (Strüver 2017, 43). These are countries of both strategic and economic importance for China. They tend to have a fair amount of economic interaction with China before they receive this partnership. Countries with comprehensive strategic partnership relations include Indonesia, Australia, South Africa, Algeria, Belarus, Hungary, Mongolia, the United Kingdom, Malaysia, Kazakhstan, Uzbekistan, Tajikistan, Argentina, Italy, Venezuela, Egypt, and Brazil among others. One trade bloc, the European Union, which is an economic and political union between 28 European countries, has also been given this form of partnership with China.

An expectation of this partnership is adherence to the One China Policy. Countries should either acknowledge that Taiwan and Tibet are inseparable parts of China or simply ignore the issue entirely. In addition, countries should refrain from dealings with the Tibetan Buddhist holy figure, the Dalai Lama, to maintain smooth relations.

Type 5: Comprehensive strategic cooperative partnership (全面战略合作伙伴关系)

This form of partnership is for countries that have deep economic interaction with China. The addition of the word “cooperative” (合作) expands the scope of bilateral relations. China’s relationship with Southeast Asian countries Vietnam, Thailand, Myanmar, Cambodia, and Laos fit into this category.

China cooperates with these countries on a full range of issues, including politics, diplomacy, trade, and development. This gamut of interaction from both the sensitive to the mundane characterise “comprehensive strategic cooperation” (全面战略合作).

Type 6: Special Partnership and Non-Partnership relations

These partnerships are for those countries that hold a unique place in China’s foreign relations. They go above and beyond the general criteria for strategic partnerships. These relationships are either a product of a shared history, close cooperation on security (military) issues, unique importance for the Chinese economy, or a combination of these factors. They indicate the country has either extremely close cooperation with China or it is very important strategically.

China holds special partnerships with Russia (unique shared history), Pakistan (close security cooperation), and Germany (unique importance for the Chinese economy). At present, each of these three countries receives their own unique type of strategic partnership.

“Non-partnership relations” indicate a combination of these significant factors—a shared history, necessary interaction in issues of military security, or unique importance for the economy—together with an unwillingness to consider the country a “partner.” These types of relationships include those with the USA, Japan, and North Korea. These countries also receive individually titled non-partnership relations.

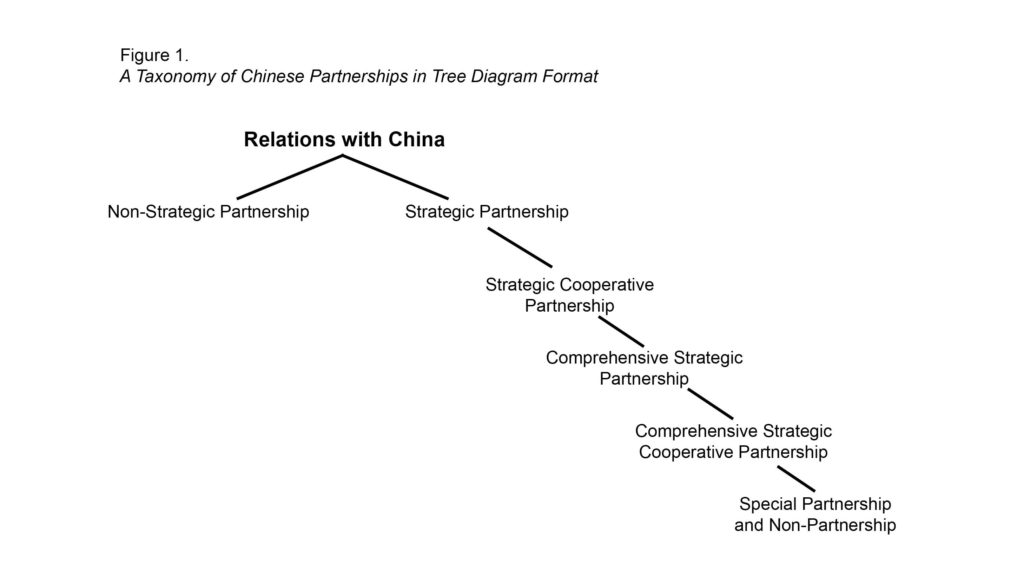

Figure 1 (below), “A Taxonomy of Chinese Partnerships in Tree Diagram Format,” shows the structure of the MFC’s partnership model of diplomacy. The tree diagram begins with the basis of all partnerships—relations with China. Fundamentally, partnerships with China are split between “non-strategic” and “strategic” categories. Assignment of a strategic partnership unlocks the potential of deepening relations to four additional types of partnership, each more significant than the level above.

The specifics of special partnership and non-partnership relations are briefly discussed below.

Pakistan: All-weather strategic cooperative partnership relations (全天候战略合作伙伴关系)

Economic development is not the crux of this bilateral relationship. It is joint security and stability. “The objective has not been to strengthen the two countries’ welfare interests, but to strengthen them against common threats. [The Pakistan-China relationship] should be described as a shield to protect their traditional security interests rather than a bridge to lead to common prosperity and wealth” (Ye 2009, 109). To be sure, this is not to say the relationship does not hold economic potential. But what makes this relationship special is its role in regional (South Asian and Central Asian) stability for China’s borderlands.

Russia: Comprehensive strategic partnership relations (全面战略协作伙伴关系)

In November 2007, Russia was the first foreign country to receive “strategic cooperative partnership relations” (战略协作伙伴关系) with China.

In June 2011, on the tenth anniversary of the signing of the “Sino-Russian treaty on friendly and cooperative neighbourly relations”, then Chinese President Hu Jintao and Russian President Dimitri Medvedev jointly agreed to add “comprehensive” (全面) to Russia’s strategic partnership symbolise the gradual deepening of ties.

While the multiple adjectives of Chinese partnerships seem to trumpet the importance of practically all bilateral relations, the Russia-China relationship is the real deal. Actions back-up the litany modifiers. From March 2013 to June 2018, Chinese President Xi Jinping and Russian President Vladimir Putin have officially met 25 times (SCMP 2018). President Xi’s first foreign visit as an acting head of state was to Russia.

China has a unique contemporary history with Russia. In addition to adjacent borders and 19th century Russian colonialism, they share Communist pasts.

Now, unlike during the Cold War, many Russian and Chinese foreign policy aims complement one another (Sangar 2018). Both seek a multipolar world order (Cheng and Wankun 2002; Lo 2015). But for China, it is primarily looking for a reliable supplier of key resources (Maçães 2018). Russia is looking to reduce its dependence on Western (EU) markets for its raw materials. China’s economy is ever-hungry for natural resources. The Power of Siberia pipeline represents an alignment of these interests. The pipeline is to pump approximately USD$400 billion in natural gas to China and is slated to start deliveries in December 2019 (Gazprom 2017).

The individually worded comprehensive strategic partnership (Russia’s partnership includes 协作 instead of 合作 like in others to indicate “cooperation”) is a subtle way of symbolically setting the relationship with Russia apart.

Germany: All-round strategic partnership relations (全方位战略伙伴关系)

Of China’s relations with European Union member states, one stands out: China’s “All-round strategic partnership” with Germany. In March 2014, during Xi Jinping’s visit to Germany, an all-round strategic partnership was signed by joint-agreement. The reason for this special treatment relates to China’s economy. Germany is China’s biggest trading partner and technology exporter in Europe (OEC 2018).

The USA, Japan, and North Korea: Non-partnership relations (非伙伴关系)

The USA, Japan, and North Korea are conspicuous for not having “partner” (伙伴) attached to their unique relationship with China. When relations lack the word “partnership,” they are categorised as non-partnership relations. All three countries have complex historical, economic, and security relationships with China. While these relationships are very important, China chooses not to associate a “partnership”—to imply a relationship of shared risks and shared development—to their bilateral interaction.

During Clinton’s administration, China assigned “strategic cooperative relations” to the USA. But relations deteriorated during the George W. Bush years. Ties were reduced to “cooperative relations.” In 2013, Xi Jinping and Obama agreed to do their utmost to create a new kind type of Sino-American great power relations. After this agreement, the formulation “new type of great power relations” (新型大国关系) became the appellation for China’s relations with the USA.

China’s post-Cold War relations with Japan have always been touch and go. In the late 1990s, China and Japan proposed to “devote their best efforts to a friendly cooperative partnership for peace and development” (Wenwei Po 2015). Despite high levels of trade (OEC 2018), the various ups and downs in the years that followed did not result in closer relations. In 2008, then Chinese President Hu Jintao visited Japan. The two sides agreed to promote “strategic mutually beneficial relations” (战略互惠关系).

In spite of their close relationship, Chinese officials often do not want to be associated with the actions of its upstart neighbour, North Korea (Shambaugh 2013, 81–82). The MFA characterises China’s foreign relations with North Korea as “traditional friendly cooperative Sino-Korean relations” (中朝传统友好合作关系). The lack of “partner” in their special relationship title clearly indicates how China both values and handles bilateral ties carefully.

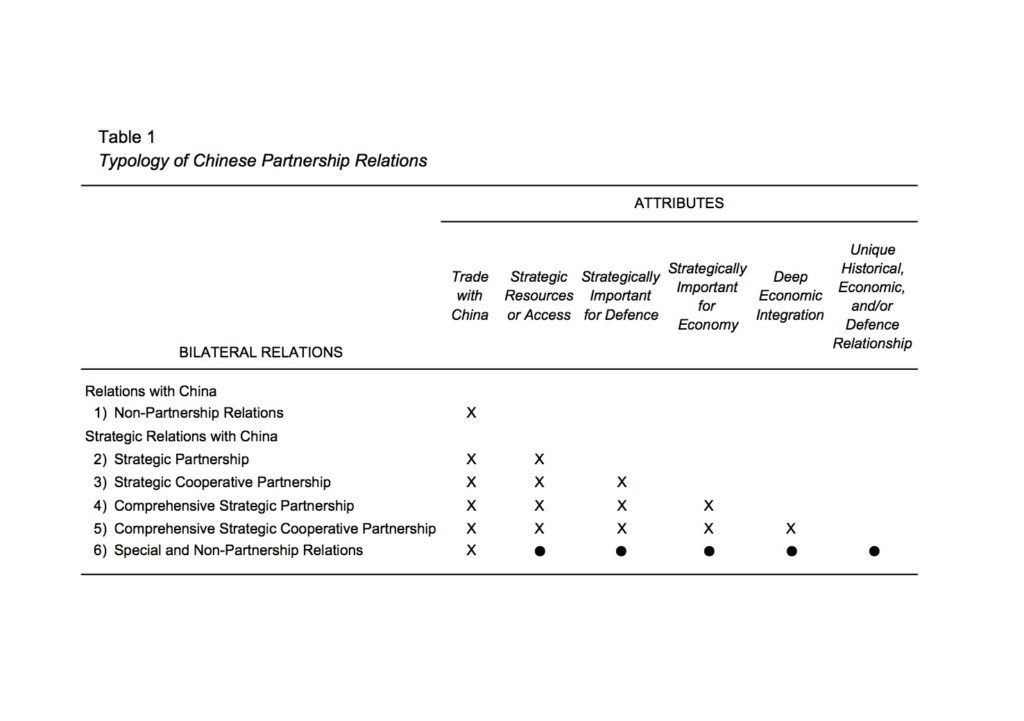

In general, the level of partnership a Eurasian country has reveals certain attributes about the bilateral relationship with China. Non-strategic partnership countries have trade with China. Strategic partnerships mean a country has a strategic resource or some form of access to resources or trade. Strategic Cooperative Partnerships are important for reasons of defence. Comprehensive Strategic Partnerships are with countries that are important for functioning or future development of China’s economy. Comprehensive Strategic Cooperative Partnerships feature countries that are deeply integrated with China’s economy. So far, only Southeast Asian countries have this form of partnership. Finally, countries with Unique and Non-Partnership relations with China—for historical, economic, or defence reasons—may have all or a mixture of these aforementioned attributes.

Table 1 above, “Typology of Chinese Partnership Relations,” arranges the partnerships and their attributes from least to greatest importance. An “X” indicates the existence of an attribute in a partnership. Bullet points indicate the attribute may or may not be an aspect of the partnership, because of its unique status.

II. Patterns of Partnership Relations in Eurasia

The above described partnerships are useful in understanding China’s approach to relations with the countries of Eurasia. Mentioned before, the level of partnerships assigned by the MFA to the countries of Eurasia correspond to China’s security concerns. These concerns are defence of Chinese borders, securitisation of key resources, and access to markets. This study finds a pattern of conditions, which relate to the level of Eurasian partnerships. The highest level of partnerships tend to have the following three conditions: (1) shared borders with China; (2) trade in strategic resources above USD$1 billion; and (3) joint projects with China that facilitate trade with Europe or supply of strategic resources. In general, countries with lesser partnerships lack one or more of these three conditions.

The practical implication of having a higher rank of partnership with China is the facilitation of trade deals, security cooperation, or large, bilateral investment projects becomes more likely (Strüver 2017, 45). To be clear, it should be noted the partnerships themselves tend to be accompanied by little action at first.“They are not about impact but rather a diplomatic attempt to see whether or not future collaboration might be feasible” (Ibid.). Partnerships are more about the future potential of closer interaction. When they are signed, there is not an immediate uptick in exchange and cooperation. It simply indicates Beijing is ready to take relations further.

Thus, the level of relations assigned to Eurasian regimes is used here to determine China’s approach to the region. This form of analysis is not original. Several studies have used the MFA’s assigned levels of relations to decipher China’s foreign policy. The following is short review of similar studies.

Cheng and Wankun (2002) discuss the origins and hierarchical organisation of China’s partnership relations. They, along with Stumbaum and Xiong (2012, 163) and Michalski and Pan (2017, 34–35), argue the partnership system is evidence of Chinese efforts to find multiple supporters for its modernisation and peaceful rise without the use of alliances (Cheng and Wankun, 255–257). Su (2009, 30–35) essentially argues the same points, but emphasizes China’s efforts to use partnerships to be of benefit to both sides, “win-win” relationships, for the aim of regional and international stability.

Dai (2016, 105–111) argues China’s partnership diplomacy is a natural reaction to a world order that has gradually been “decentralised”—moving from the US-dominated unipolar system to a multipolar one. The multi-level (hierarchical), diversified (there are various different kinds), and multi-variate (designed to accommodate various different types of relationships) features of these partnerships enable China to take advantage of changing circumstances and promote its peaceful rise (Dai 2016, 101–104). Similarly, Feng and Huang (2014, 11–15) argue the proliferation of Chinese partnership is a product of China’s embrace of globalisation and multidimensional diplomacy.

Bang (2017, 381) argues China’s multi-layered system of partnership relations, in fact, serves the purpose of gradually increasing its normative power. Bang defines normative power as the ability to introduce and develop accepted practices between nations through relational dialogue rather than formal rule setting. “Even if there is no immediate uptick in substantive collaboration succeeding a new designation of bilateral relations, the label has already served its purpose by embedding the relations in a sustained process and community of practice” (Ibid., 394).

Strüver (2017) conducts the most up-to-date and thorough investigation of China’s strategic partnerships. Strüver’s goal is to find the determinants of China’s partnerships. He hypothesizes that formation of a partnership reflects China’s interests (strategic resources and trade) or shared ideology (similar voting on issues within the UN General Assembly) in a partner. Strüver (2017, 50) finds economic interest and the strength of a country’s regional military capabilities are the most prominent drivers of China’s partnerships. In particular, a country’s petroleum and metal production were strong indicators for higher levels of partnership with China.

Many articles (Cooley 2012, 70–71; Faqir and Islam 2013; Yeliseyev 2013; Eder 2014) hail the signing of Chinese strategic partnerships by Eurasian states as foreign policy milestones. But none (known thus far to this author) use China’s system of strategic partnerships to assess China’s approach to Eurasia.

The fact that comparing China’s partnership system with empirical evidence of its foreign policy concerns has yet to be used as a method to analyse China’s approach to Eurasia is further justification for this post. The overview of China’s partnership system (above) and the comparison method (described below) may be useful for other researchers to use in different contexts or regions—such Africa or South East Asia.

Methodology and Methods Used

The main task for this study is to establish a link from China’s partnerships to its foreign policy concerns (border defence, strategic resources, and access to markets). This, in turn, may help explain the level of partnership China awards to Eurasian countries, and show which countries are most important to China.

The methodology for this study is based in a logical-positivist epistemology. This epistemology dictates that knowledge about the world can only be formed on the basis of measurable evidence. Therefore, this study searches for empirical indicators that correspond to these security concerns and then compares them to the level partnership a country has.

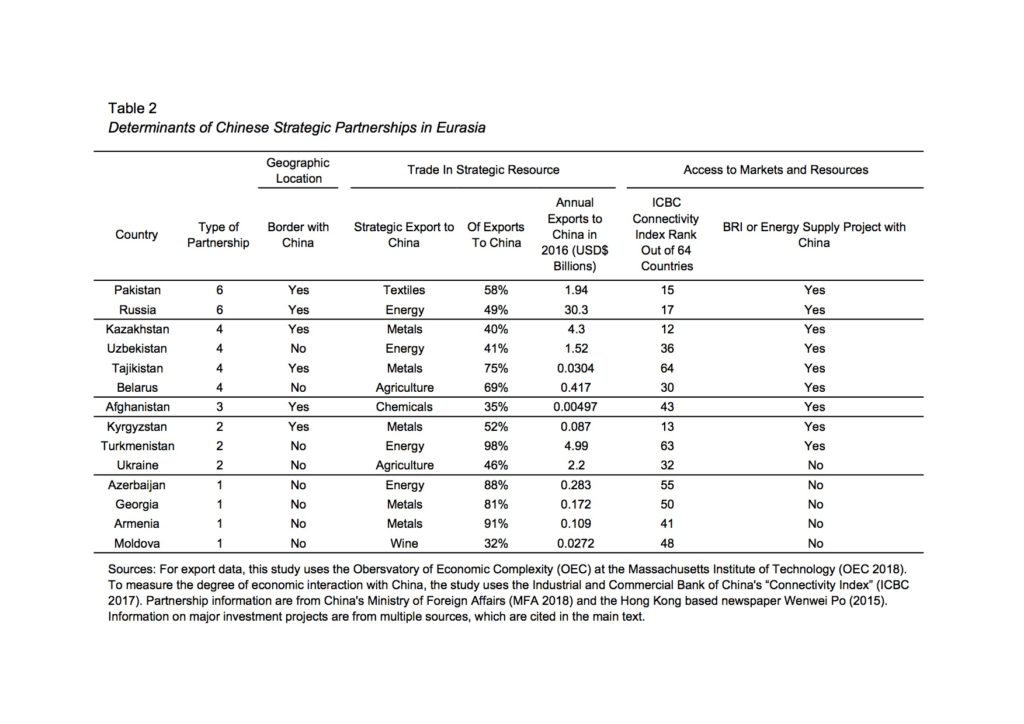

The method devised against these methodological requirements is straight forward. A table is used (see table 2 below) to compare a country’s level of partnership to empirical factors that reflect China’s security concerns. To begin, the type of partnership China has with a Eurasian country is specified under “Type of Partnership.” The type of partnership is ranked the same as the list at the top of this post—1 being the least important and 6 being the most important partnership.

Next, a series of indicators that correspond to China’s security concerns are compiled. These indicators are arranged in three groups (see table 2 below). The first is “Geographic Location.” This indicator is operationalised by whether or not a country shares a border with China. This is considered is important for issues of border defence. The further a country is from China, the reasoning goes, the less immediate any issues of territorial integrity. If the country borders China, then it is likely China will have a strategic partnership with it.

The second indicator group is “Trade In Strategic Resources” from a Eurasian country. Strategic resources are either energy (petroleum products and natural gas), metals (ore, minerals and precious metals), or agriculture (grains, dairy, or fertiliser). These strategic resources correspond to energy, economic, and food security. If table 2 lists an export other than “energy,” “metal,” or “agriculture,” the export is not a strategic resource.

This second indicator group is made up of three parts. First, a Eurasian country’s most prominent single export category to China is identified. This appears under the “Major Export to China” subheading. If this export category is a strategic resource, there is a greater likelihood for a higher level of strategic partnership.

The second part of the indicator group, under the subheading “Of Exports To China,” shows the percentage this single export category makes up of total exports to China. This percentage is used to identify what type of goods China values from a target country. If the percentage of this single export category is high, for example 35 precent or higher (making up more than one-third of all exports), this export is arguably a noteworthy aspect in bilateral relations for China or the target country.

The third part of the “Trade In Strategic Resources” indicator group is the annual total exports to China from a country. Under the subheading “Annual Exports to China in 2016 (USD$ Billions),” this demonstrates whether or not trade of the strategic resource is in a volume that may be impactful for China. The higher the value, the greater the importance of the trade in the strategic resource. Considering the size of the Chinese economy, total annual trade below USD$1 billion is not of great importance for China.

The third indicator group is “Access to Markets and Resources.” This helps justify the level of partnership by whether or not the Eurasian country in question has the potential to facilitate access to new markets or to additional strategic resources.

To determine potential access to new markets, a pair of measures are used. The first measure is the level of “connectivity” a country has with China’s economy. Connectivity calculates the degree of bilateral interaction in economic outputs (incorporating trade in goods and services), the exchange of capital (including different types of investment flows), and the flow of people (specifically, the exchange of workers and tourists across borders) (ICBC 2017, 8). ICBC (Industrial and Commercial Bank of China) and Oxford Economics (a London-based, private research institute) have made this into a index ranking 64 countries, which they consider part of the BRI. Table 1 below, under “ICBC Connectivity Index Rank Out of 64 Countries,” displays the Eurasian country’s rank out of 64. If the rank number is high (30 or above), the potential for Chinese businesses to do well is greater. Higher connectivity, although not essentially a strategic attribute, arguably has a marginal effect on deeper bilateral ties.

The second measure in the “Access to Markets and Resources” group is infrastructure projects involving China. These can be either (1) a BRI project involving Chinese financing or construction firms or (2) an energy infrastructure project to supply China with additional resources. A country either does or does not have one of these projects, which corresponds to a “Yes” or “No” on table 2. The existence of a project indicates that China is actively taking steps to access markets or strategic resources. This means there is on-going cooperation with China on one of its strategic aims—the BRI or securing strategic resources.

Findings: A Pattern Emerges

By comparing partnership levels with indicators of Chinese security concerns in table 2 above, a pattern emerges. For the 10 countries with strategic partnerships and higher (types 2 up to 6), all except Ukraine currently have a BRI or strategic resource supply project with China. Six of the 10 countries share borders with China, and half supply strategic resources and trade of more than USD$ 1 billion annually with China.

A hierarchy of attributes begins to emerge if the different levels among the strategic partnerships are inspected. Among the higher level partnerships (types 3, 4, and 6), the majority share borders with China.4Do note, there are not type 5 partnerships, because those are for South East Asian countries, as the description in part I above specifies. If there are no shared borders, the level of partnership is explained either by strategic resources or by a BRI or strategic resource supply project with China.

Thus, the higher the level of partnership in Eurasia, the greater the likelihood of the following features: (1) borders with China; (2) trade in strategic resources; or (3) the existence of BRI or energy supply projects with China. Non-strategic partnerships do not have these three attributes. These three attributes represent China’s approach to Eurasia. In its foreign relations with the countries of Eurasia, the evidence suggests China prioritises borders, strategic resources, and access to new markets and new strategic resources in that order. Non-strategic partnerships in Eurasia indicate these three attributes are lacking in bilateral relations.

Russia and Kazakhstan clearly display these three attributes in table 2. Therefore, they have high-level partnerships (type 6 and type 4 respectively). Both have multiple BRI or energy related projects with China (Gazprom 2017; PwC 2017). Both trade great volumes of strategic resources, especially Russia. They cooperate with China on anti-terrorism issues and are influential states within Central Asia (Cooley 2012). Their partnership ranks are easy to explain.

Tajikistan has low levels of exports, suggesting trade in strategic resources is not essential to China. Moreover, corruption and unclear property rights place Tajikistan at the bottom of the ICBC’s connectivity index at 64th (Huang 2017). However, Tajikistan’s shared borders, BRI and energy related projects (for example, a highway linking Tajikistan and Uzbekistan, and participation in a natural gas pipeline to China), cooperation on anti-terrorism efforts with China, and Chinese business interests in gold mining and other precious metals make up for this (Pyrkalo 2016; Huang 2017; Taldybayeva 2017). This justifies Tajikistan’s high-ranking partnership (type 4).

Turkmenistan also sits comfortably in table 2 with its strategic partnership (type 2). It lacks a border with China, but has exports to China based almost entirely on energy at 98 percent. There are no BRI projects with China yet, however, there are joint natural gas pipeline projects. Turkmenistan has established BRI related projects on its own—largely because it has the funds to do so. Although, the SREB is likely too young and economic links with China too weak (Turkmenistan is ranked 63 of 64 in the ICBC’s connectivity index). Turkmenistan can be considered a strategic partner for China, but its distance from China and singular focus on energy do not make it of great importance.

Azerbaijan, Georgia, Armenia, and Moldova have none of the three attributes that make for a strategic partnership with China. If there any BRI related projects, these do not yet involve China (Humbatov 2017; Jardine 2018; Financial Tribune 2018; Wright 2017; Liu 2017). Therefore, while there is certainly trade with China, none of the countries yet represent strategic partners.

There do, however, appear to be outliers. Kyrgyzstan has borders with China, but it only has a strategic partnership (type 2), which seems low when compared to other countries that share borders. Conversely, Uzbekistan does not have borders with China, yet it has a Comprehensive strategic partnership (type 4). Belarus has neither borders nor moderate levels of trade (its annual trade is less than half a USD$ billion) with China. Ukraine lacks borders, too, and has no BRI or strategic resource projects underway with China. Afghanistan and Pakistan do not trade in strategic resources at all.

In fact, these countries are not outliers. They can be explained either by expanding on data within table 2 or by the nature of the partnerships they hold. The following paragraphs explain why Kyrgyzstan, Uzbekistan, Belarus, Ukraine, Afghanistan, and Pakistan are not outliers.

The reason Kyrgyzstan has a relatively low-level partnership with China is first apparent in its annual export levels to China in table 2 above. In 2016, total exports from Kyrgyzstan to China valued only USD$87 million. As Colarizi (2015) notes, on paper, relations should be close. There is a high level of economic connectivity, they share borders, and the country currently has two BRI related infrastructure projects and one energy project with China. The BRI projects are the Pamir (North South) Highway and construction for a Uzbek-Kyrgyz-China railway. Kyrgyzstan is also building a section of the Central Asia Pipeline, a Turkmen-Uzbek-Tajik-Kyrgyz-China natural gas project (Taldybayeva 2017). All the same, Kyrgyzstan has mountainous, difficult terrain to build infrastructure, it is poor and lacks energy resources (unlike Kazakhstan, for example), it is corrupt, and, on occasion, politically unstable (Li and Pantucci 2013; Putz 2018; Schwartz and Khamidov 2016). These factors have held the development of relations back. Kyrgyzstan is strategically important to China, participating in various cross-border projects. Like the description of an MFA strategic partnership outlines in part I above, relations are growing, just slowly.

On the other hand, Uzbekistan lacks a strategically important border with China, yet it has a high-level partnership with China. As the high-level partnership suggests, China and Uzbekistan have close ties in a number of areas. The two countries have long cooperated on regional security issues, such a combating terrorism (Koparkar 2017). Additional areas of cooperation are indicated in table 2 under the “Trade In Strategic Resource” and “Access to Markets and Resources” groupings. There is non-negligible strategic resource trade (Energy at 41 percent of exports, with more than $USD 1 billion in annual exports) and BRI and energy projects with China. Uzbekistan is relatively resource rich (Koparkar 2017). Mentioned above, Uzbekistan is part of the Central Asia Pipeline. The Uzbek section of the pipeline is already completed (SCMP 2017). Its geographic location, in the middle of Central Asia, makes Uzbekistan an important transit country for the BRI. A highway from Xinjiang, passing through Osh in Southern Kyrgyzstan, to Uzbekistan’s capital Tashkent officially opened in February (Belt and Road Portal 2018). Talks to finalise a China–Kyrgyzstan–Uzbekistan railway are still underway (Kabar 2018). A main feature of the railway will be a link to the Mingbulak oil field in Uzbekistan’s region of the Ferghana Valley (Trend 2018). Despite lacking a border with China, the weight of other Chinese strategic interests, such as transit along the BRI and energy resources, Uzbekistan is an important strategic partner for China.

Belarus also appears to be an outlier within table 2. It has no border with China and its trade in strategic resources is mostly irrelevant. Total exports to China in 2016 were slightly more than USD$ 400 million. The thing that sets Belarus apart within Eurasia is its place within the SREB. Table 2 notes that Belarus has one or more projects with China enables access to markets or strategic resources. The Great Stone Industrial Park is the major Belarusian project with China (financed as officially part of the BRI) (Xinhua 2018). The park is a business and industry incubator, which connects to Belarus’s railway system. The park is essentially to function as a manufacturing and logistics hub for SREB trade (Republic of Belarus 2018; Xinhua 2018). Thus, the BRI and SREB have expanded China’s ambitions and in doing so have extended the scope of strategic locations, which are access points to markets. Thanks to the SREB, Belarus is part of China’s strategic access to trade via Eurasia to Europe.

Although Ukrainian exports to China are not insignificant (USD$2.2 billion in 2016) and 46 percent of those exports are in a strategic resource, Ukraine is the only strategic partnership holder to not currently have a BRI or energy project with China (see table 2). The reason for this is because in 2011, at the time of the signing of Ukraine’s strategic partnership with China, there was an active strategic resource project with China. In 2009, Ukraine laid the groundwork for expanding agricultural exports to China (Xinhua 2009). Increasing Chinese interests culminated in the multi-billion US dollar Chinese funded Saki Deep-water port. The rationale was grain exports to China (Izmirli 2014). The project was dropped after Russia annexed Crimea (Liu 2016). China is currently negotiating a new site on Ukraine’s coast to build a port with similar capacities (Goncharuk et al. 2016, 19). Ukraine still holds its strategic partnership with China. As other researchers have argued (Feng and Huang 2014; Strüver 2017), this demonstrates that China understands its partnerships as long-term, works in progress. Partnerships do not change suddenly in reaction to world events.

At first, the level of partnership awarded to Afghanistan and Pakistan may seem out of place. Pakistan has the highest level partnership—type 6, a special partnership with China that no other country shares. But Pakistan does not export strategic resources to China. In comparison, another country with its own special partnership, Russia, exports massive amounts of strategic resources. Afghanistan, with no major strategic resource trade and extremely low levels of exports to China, somehow has a (type 3) strategic cooperative partnership with China. The explanation for such high partnership levels, despite table 2 indicators suggesting otherwise, is the roles both these countries play in regional security. As the partnership descriptions at the top of this post note, both Pakistan’s and Afghanistan’s partnerships are preoccupied with issues of defence and stability for China. This means that certain attributes, such as shared borders, will count a great deal more than trade and market access to China’s strategic considerations.

The results here do not seem so different to Struver’s (2017) conclusions about China’s partnership relations. Countries that are regional military powers and suppliers of energy and metals do, indeed, tend to be recipients of higher-level partnerships. However, what the current study shows to be a new, additional factor in determining China’s partnership relations is the impact BRI and SREB related infrastructure projects have for partnership levels. Belarus, with its lack of regional military influence and low levels of trade with China, but also with a BRI-backed project and a high-level partnership, is the clearest indication of this difference. The method used in this study is more specific, and therefore helps to explain apparent outliers in the determinants of China’s Eurasian partnership relations.

Establishing an empirical connection from China’s partnerships to its foreign policy concerns begins to expose a methodical approach to relations in Eurasia. Through the examination of discrepancies among countries against their partnership levels, a pattern emerges. In general, certain features, such as border security, trade in strategic resources, and access to markets and additional resources, do much to determine the closeness of relations with China. Apparent outliers among the countries are explained by inspection of their relationships with China.

III. A Hierarchy of Eurasian Relations

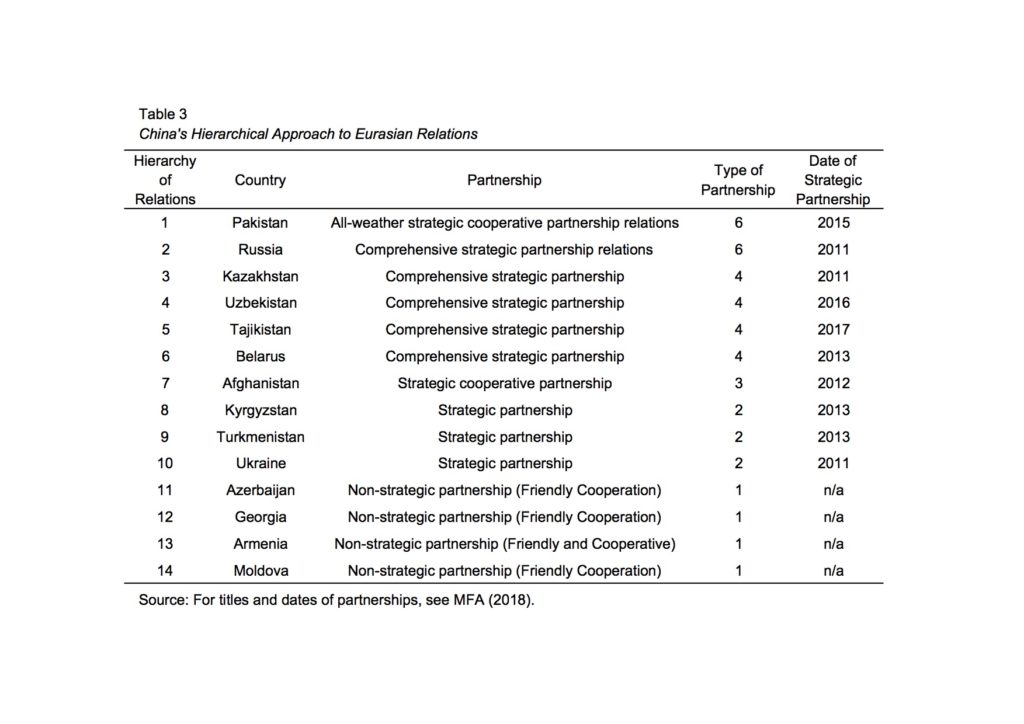

Understanding the subtleties of China’s partnership diplomacy (discussed in part I of this post) and the general features that determine the importance of relations in Eurasia, it is possible to build a hierarchy of Eurasian relations. Table 3 below, “China’s Hierarchical Approach to Eurasian Relations,” displays this hierarchy.

The first column in table 2 above, “Hierarchy of Relations,” ranks a country’s importance for China’s foreign relations in Eurasia. The “Country” column immediately to the right names the ranked country. Under “Partnership” are the exact partnerships China has assigned each state. “Type of Partnership” is a simple numbering system, which corresponds to the numbered list and discussion of each type of partnership that make up part one of this post, “I. China’s Strategic Partnerships.” The most important type of partnership is numbered 6. The five remaining partnership types decrease in importance from 5 down to 1. The final column, “Date of Strategic Partnership,” gives the date the current and highest form of strategic partnership was assigned to a country. Countries without strategic partnerships are listed as “n/a.”

The top spots in the hierarchy, 1 and 2, held by Pakistan and Russia, are essentially interchangeable. Pakistan has been given first place, because it more recently had “all-weather” (全天) added to its already special strategic cooperative partnership (Wenwei Po 2015).

Kazakhstan, Uzbekistan, Tajikistan, and Belarus all have type 4, comprehensive strategic partnerships. The first three have been arranged by the value of their exports to China (see table 2). They take spots 3, 4, and 5. Belarus has been ranked below Tajikistan, because while both countries’ exports are negligible, Tajikistan shares borders with China. Therefore, Belarus takes spot number 6.

Afghanistan has its rank based on partnership type. It is a type 3, a strategic cooperative partnership, which focuses more on security and strategic areas and less on the economy, trade, and investment. While it lacks the economic aspects of type 4, comprehensive strategic partnerships, it is more strategically important than the simpler type 2, strategic partnership. Afghanistan is placed just below Belarus in spot 7.

Kyrgyzstan, Turkmenistan, and Ukraine all have type 2, strategic partnerships. Kyrgyzstan has borders with China, and therefore takes spot 8, above the other two. Turkmenistan exports more strategic resources to China than Ukraine, so it is ranked higher than Ukraine. Turkmenistan gets spot 9 and Ukraine get spot 10.

The final four Eurasian countries, Azerbaijan, Georgia, Armenia, and Moldova have type 1, non-strategic partnerships. They have not received strategic partnerships, and thus have “n/a” in the date of strategic partnership column. These countries are ordered by first type and then value of their exports to China. Strategic resources take precedence over non-strategic. Next, a greater value of exports is ranked higher. Thus, Azerbaijan, Georgia, Armenia, and Moldova take spots 11, 12, 13, and 14 respectively.

Conclusion

This study has shown China’s approach to Eurasia can be identified via various MFA partnerships assigned to the countries of the region. China’s approach to the Eurasia is fundamentally based on Chinese foreign policy concerns. These concerns are defence of China’s borders, securitisation of key resources, and access to markets and additional resources. Empirical factors representative these security concerns—the existence of shared borders, trade in strategic resources (petroleum, metals production, or agriculture), and bilateral infrastructure projects with China that facilitate trade—help determine a hierarchy of MFA partnerships. Therefore, the partnerships assigned to the countries of Eurasia together with the conditions generally required by each partnership level can be used to establish how much China values each country in the region.

Part I of this study, “China’s Partnership Relations,” outlined the different types and levels of China’s partnership system. Part II, “Patterns of Partnership Relations in Eurasia,” put forward the study’s central argument by connecting partnership levels to empirical factors indicative of China’s central foreign policy concerns. Lastly, Part III, “A Hierarchy of Eurasian Relations,” combines the descriptions of partnership levels in part I and the findings of part II to construct a hierarchy of China’s foreign relations in Eurasia.

The combined parts of this study have produced two practical results. The first is that by identifying the partnership level China has with a Eurasian country, certain assumptions can be made about the importance of the bilateral relations for China. The second is highlighting the SREB (as part of the BRI) as a new determinant of partnership relations in Eurasia, of which the China-Belarus relationship is such a clear example of.

Mentioned above, regions where a similar study is applicable are Africa and South East Asia. This may lead to refinements of the comparative method devised here.

Author: Peter Braga

Word count: 7,628

References

Bang, J. (2017). Why So Many Layers? China’s “State-Speak” and Its Classification of Partnerships. Foreign Policy Analysis, 13, 380–397. DOI: http://dx.doi.org/10.1093/fpa/orw063.

Click here to jump back up to article.

Belt and Road Portal. (2018, February 27). China-Kyrgyzstan-Uzbekistan highway opens to traffic. China Belt and Road Portal. Retrieved from: https://eng.yidaiyilu.gov.cn/home/rolling/49136.htm.

Click here to jump back up to article.

Cheng, J. Y. S. and Wankun, Z. (2002). Patterns and Dynamics of China’s International Strategic Behaviour. Journal of Contemporary China, 11: 31, 235–260, DOI: http://dx.doi.org/10.1080/10670560220129612.

Click here to jump back up to article.

China Eurasia Expo. (2018). Forum Activities. Retrieved from the China-Eurasia Expo Website: http://en.caeexpo.org/ForumActivities/11.html.

Click here to jump back up to article.

Colarizi, A. (2015, August 11). China and Kyrgyzstan: So Near, Yet So Far. The Diplomat. Retrieved from: https://thediplomat.com/2015/08/china-and-kyrgyzstan-so-near-yet-so-far/.

Click here to jump back up to article.

Cooley, A. (2012). Great Games, Local Rules: The New Great Power Contest in Central Asia. New York: Oxford University Press.

Click here to jump back up to article.

Cowhig, D. (2017, July 04). China’s Diplomacy: How Many Kinds of Major and Minor Partner “Relations” 夥伴關係 Does China Have?. 高大伟 David Cowhig’s Translation Blog. Retrieved from: https://gaodawei.wordpress.com/2017/04/07/chinas-diplomacy-how-many-kinds-of-major-and-minor-partner-relations-%E5%A4%A5%E4%BC%B4%E9%97%9C%E4%BF%82-does-china-have/.

Click here to jump back up to article.

CRI. (2016, September 20). “Dì wǔ jiè zhōngguó—yà ōu bólǎnhuì zài wūlǔmùqí kāimù” [The Fifth China–Eurasia Expo Opens in Urumqi]. CRI News Network. Retrieved from: http://news.cri.cn/20160920/173b6153-8a0e-40ca-38c7-e1552024e576.html.

Click here to jump back up to article.

Dai, W. L. (2016). China’s Strategic Partnership Diplomacy (Du Weiwei, Trans.). Contemporary International Relations [现代国际关系], 26: 1, 101–116.

Click here to jump back up to article.

Eder, T. S. (2014). China-Russia Relations in Central Asia. Wiesbaden: Springer.

Click here to jump back up to article.

Faqir, K. and Islam, F. (2013). Pak-China and Central Asia Strategic Partnership: An Analysis. Pakistan Perspectives, 18: 2, 121–132. Retrieved from: https://web.b.ebscohost.com/abstract?direct=true&profile=ehost&scope=site&authtype=crawler&jrnl=18105858&AN=98556741&h=ungFEek5m1o0opFKMjqGYJoRVv21gmeoIYYhPFEv0VDFaYDWjsyNvlfGXafx5GaO2Q%2feOkCPyRBg29MWRytHfw%3d%3d&crl=c&resultNs=AdminWebAuth&resultLocal=ErrCrlNotAuth&crlhashurl=login.aspx%3fdirect%3dtrue%26profile%3dehost%26scope%3dsite%26authtype%3dcrawler%26jrnl%3d18105858%26AN%3d98556741.

Click here to jump back up to article.

Feng, Z. P. and Huang, J. (2014). China’s strategic partnership diplomacy: engaging with a changing world (Working Paper 8, June 2014). Fundación para las Relaciones Internacionales y el Diálogo Exterior (FRIDE), Madrid, Spain. Retrieved from: http://fride.org/download/wp8_china_strategic_partnership_diplomacy.pdf.

Click here to jump back up to article.

Financial Tribune. (2018, March 06). China Interested in Iran-Armenia Rail Project. Financial Tribune. Retrieved from: https://financialtribune.com/articles/economy-business-and-markets/83024/china-interested-in-iran-armenia-rail-project.

Click here to jump back up to article.

Gazprom. (2017, July 04). Russian gas supplies to China via Power of Siberia to start in December 2019 [Press Release]. Gazprom. Retrieved from: http://www.gazprom.com/press/news/2017/july/article340477/.

Click here to jump back up to article.

Goncharuk, A., Hobova, E., Kiktenko, V., Koval, A. and Koshovy, S. (2016). Foreign Policy Audit: Ukraine-China. Kyiv, Ukraine: Institute of World Policy. Retrieved from: http://iwp.org.ua/eng/public/2144.html.

Click here to jump back up to article.

Heath, T. R. (2012). What Does China Want? Discerning the PRC’s National Strategy. Asian Security, 8: 1, 54–72. DOI: http://dx.doi.org/10.1080/14799855.2011.652024.

Click here to jump back up to article.

Huang, K. (2017, October 07). Why Chinese investors are struggling to gain a foothold in Tajikistan. South China Morning Post. Retrieved from: http://www.scmp.com/news/china/diplomacy-defence/article/2113810/why-chinese-investors-are-struggling-gain-foothold.

Click here to jump back up to article.

Humbatov, M. (2018, April 05). Azerbaijan within the Context of the Silk Road. International Policy Digest. Retrieved from: https://intpolicydigest.org/2018/04/05/azerbaijan-within-the-context-of-the-silk-road/.

Click here to jump back up to article.

ICBC. (2017). Belt and Road China Connectivity Index. ICBC Standard Bank (July 2017). Retrieved from: https://www.oxfordeconomics.com/icbc-standard-bank-belt-and-road-economic-indices-oe.

Click here to jump back up to article.

Izmirli, I. P. (2014). Sale of Crimean Land by Yanukovych: ‘Made in/for China’. Eurasia Daily Monitor, 11: 24. Retrieved from: http://www.jamestown.org/single/?tx_ttnews%5Btt_news%5D=41930&no_cache=1#.V1BK5L4rJP0.

Click here to jump back up to article.

Jardine, B. (2018, February 21). With Port Project, Georgia Seeks Place on China’s Belt and Road. Eurasianet. Retrieved from: https://eurasianet.org/s/with-port-project-georgia-seeks-place-on-chinas-belt-and-road.

Click here to jump back up to article.

Koparkar, R. (2017, February 16). 25 Years of Uzbekistan-China Relations: Enhanced Economic Engagements marked by Political Understanding. Vivekananda International Foundation. Retrieved from: https://www.vifindia.org/article/2017/february/16/25-years-of-uzbekistan-china-relations-enhanced-economic-engagements-marked-by-political-understanding.

Click here to jump back up to article.

Lane, D. and Zhu, G. (eds). (2018). Changing Regional Alliances for China and the West. London, UK: Lexington Books.

Li, L. F. and Pantucci, R. (2013, January 24). Decision time for Central Asia: Russia or China? Open Democracy. Retrieved from: https://www.opendemocracy.net/od-russia/li-lifan-raffaello-pantucci/decision-time-for-central-asia-russia-or-china.

Click here to jump back up to article.

Liu, Z. (2017, December 29). Can a China-Moldova free-trade deal give Beijing a foothold in eastern Europe? South China Morning Post. Retrieved from: http://www.scmp.com/news/china/diplomacy-defence/article/2126179/can-china-moldova-free-trade-deal-give-beijing-foothold.

Click here to jump back up to article.

Liu, Z. K. (2016). The Analysis of the Relationship between China and Ukraine. 16+1 China CEEC Think Tank Network. Retrieved from: http://16plus1-thinktank.com/1/20160111/1095.html.

Click here to jump back up to article.

Lo, B. (2015). Russia and the New World Disorder. Washington, DC: Brookings Institution Press.

Click here to jump back up to article.

Maçães, B. (2018). Dawn of Eurasia: Following the New Silk Road. London, UK: Allen Lane.

Click here to jump back up to article.

MFA. (2018). “Guójiā hé zǔzhī” [Countries and Regions]. Retrieved from the Ministry of Foreign Affairs of the People’s Republic of China: http://www.fmprc.gov.cn/web/gjhdq_676201/.

Click here to jump back up to article.

Michalski, A. and Pan, Z. Q. (2017). Unlikely Partners? China, the European Union and the Forging of a Strategic Partnership. Singapore: Palgrave Macmillan. DOI: http://dx.doi.org/10.1007/978-981-10-3141-0_2.

Click here to jump back up to article.

MOFCOM. (2011, September 01). Welcome to China-Eurasia Expo. Ministry of Commerce of the People’s Republic of China. Retrieved from: http://bg2.mofcom.gov.cn/article/links/201106/20110607594232.shtml.

Click here to jump back up to article.

MOFCOM. (2014, September 1). China-Eurasia Expo opens in Xinjiang. Ministry of Commerce of the People’s Republic of China. Retrieved from: http://english.mofcom.gov.cn/article/zt_eurasia2014/news/201411/20141100802542.shtml.

Click here to jump back up to article.

OEC. (2018). [Interactive “Tree Map” showing countries arranged by continental regions and the percentages of the origins of Chinese imports and the destinations of Chinese exports] Countries: China. Observatory of Economic Complexity. Retrieved from: https://atlas.media.mit.edu/en/profile/country/chn/.

Click here to jump back up to article.

Pan, Z. Q. (ed). Conceptual Gaps in China–EU Relations: Global Governance, Human Rights and Strategic Partnerships. Hampshire, UK: Palgrave Macmillan.

Putz, C. (2018, June 07). Kyrgyzstan Navigates Domestic Political Firestorm, Hopes to Avoid Burning China. The Diplomat. Retrieved from: https://thediplomat.com/2018/06/kyrgyzstan-navigates-domestic-political-firestorm-hopes-to-avoid-burning-china/.

Click here to jump back up to article.

PwC. (2017). Kazakhstan and the New Silk Road [promotional material]. PricewaterhouseCoopers. Retreived from: https://www.pwc.kz/en/publications/new-2017/silk-way-publication-eng.pdf.

Click here to jump back up to article.

Pyrkalo, S. (2016, June 24). Road project in Tajikistan becomes first joint EBRD-AIIB investment. European Bank for Reconstruction and Development [Press Release]. Retrieved from: https://www.ebrd.com/news/2016/road-project-in-tajikistan-becomes-first-joint-ebrdaiib-investment.html.

Click here to jump back up to article.

Republic of Belarus. (2018). Industrial Park Great Stone. Official Website of the Republic of Belarus. Retrieved from: http://www.belarus.by/en/business/business-environment/industrial-park-great-stone.

Click here to jump back up to article.

Sangar, K. S. (2018). Russia and China as the Yin-and Yang of 21st Century Eurasia? In David Lane and Guichang Zhu (eds), Changing Regional Alliances for China and the West (199–223). London, UK: Lexington Books.

Click here to jump back up to article.

Schwartz, C. and Khamidov, A. (2016, August 16). Kyrgyzstan: Corrupt, Anarchic – and Stable? The Diplomat. Retrieved from: https://thediplomat.com/2016/08/kyrgyzstan-corrupt-anarchic-and-stable/.

Click here to jump back up to article.

SCMP. (2017, December 05). China, Uzbek joint natural gas project ready to start pumping. South China Morning Post. Retrieved from: http://www.scmp.com/news/china/diplomacy-defence/article/2122933/china-uzbek-joint-natural-gas-project-ready-start.

Click here to jump back up to article.

SCMP. (2018, June 07). Putin state visit to China reflects strengthening of Sino-Russia ties amid US pressure. South China Morning Post. Retrieved from: https://www.scmp.com/news/china/diplomacy-defence/article/2149665/putin-state-visit-china-reflects-strengthening-sino.

Click here to jump back up to article.

Shambaugh, D. (2013). China Goes Global: The Partial Power. New York, NY: Oxford University Press.

Click here to jump back up to article.

Strüver, G. (2017). The Chinese Journal of International Politics. The Chinese Journal of International Politics, 10: 1, 31–65. DOI: https://doi-org.libproxy.ucl.ac.uk/10.1093/cjip/pow015.

Click here to jump back up to article.

Stumbaum, M. B. U. and Xiong, W. (2012). Conceptual Differences of Strategic Partnership in EU–China Relations. In Zhongqi Pan (Ed) Conceptual Gaps in China–EU Relations: Global Governance, Human Rights and Strategic Partnerships (pp. 156–170). Hampshire, UK: Palgrave Macmillan.

Click here to jump back up to article.

Su, H. (2009). Harmonious World: The Conceived International Order in Framework of China’s Foreign Affairs (Joint Research Series 3: pp. 29–55). Retrieved from The National Institute for Defense Studies (NIDS), Japan: http://www.nids.mod.go.jp/english/publication/joint_research/series3/pdf/3-2.pdf.

Click here to jump back up to article.

Taldybayeva, D. (2017, March 28). Prospects for China – Kyrgyzstan Economic Relations in the Framework of the Silk Road Economic Belt Project. HKTDC. Retrieved from: http://china-trade-research.hktdc.com/business-news/article/The-Belt-and-Road-Initiative/Prospects-for-China-Kyrgyzstan-Economic-Relations-in-the-Framework-of-the-Silk-Road-Economic-Belt-Project/obor/en/1/1X000000/1X0A9JIX.htm.

Click here to jump back up to article.

Trend. (2018, June 22). How can Iran’s involvement affect China-Kyrgyzstan-Uzbekistan railway project? Azernews. Retrieved from: https://www.azernews.az/region/133809.html.

Click here to jump back up to article.

Wen, J. B. (2004, May 06). Vigorously Promoting Comprehensive Strategic Partnership between China and the European Union. Mission of the People’s Republic of China to the European Union. Retrieved from: http://www.chinamission.be/eng/zt/t101949.htm.

Click here to jump back up to article.

Wenwei Po. (2015, April 22). “Zhōngguó yǔ dàxiǎo huǒbàn yǒu duōshǎo zhǒng guānxì”[China and Its Partners Have How Many Types of Relations?]. Wenwei Po. Retrieved from: http://news.wenweipo.com/2015/04/22/IN1504220007.htm.

Click here to jump back up to article.

Wright, C. (2017, September 26). Making sense of Belt and Road – The Belt and Road country: Armenia. Euromoney. Retrieved from: https://www.euromoney.com/article/b14t180fwf28pm/making-sense-of-belt-and-road-the-belt-and-road-country-armenia.

Click here to jump back up to article.

Xinhua. (2009, July 4). Ukrainian PM meets senior Chinese official on bilateralties. Xinhua News Agency. Retrieved from: http://news.xinhuanet.com/english/2009-07/04/content_11651104.htm.

Click here to jump back up to article.

Xinhua. (2018, May 14). Spotlight: China-Belarus industrial park sees rapid development. Xinhua News Agency. Retrieved from: http://www.xinhuanet.com/english/2018-05/14/c_137178753.htm.

Click here to jump back up to article.

Ye, H. L. (2009). China-Pakistan Relationship: All-Weathers, But Maybe Not All-Dimensional. In Kristina Zetterlund (ed.), Pakistan—Consequences of Deteriorating Security in Afghanistan (pp. 108–130). Stockholm: Swedish Defence Research Agency. Retrieved from: https://www.foi.se/report-search/pdf?fileName=D%3A%5CReportSearch%5CFiles%5C5cd7239f-1b9f-4da5-8098-521809ab469b.pdf.

Click here to jump back up to article.

Yeliseyev, A. (2013). Some Aspects of Belarusian-Chinese Relations in the Regional Dimension: Much Sound and Little Sense (Report No. SA #08/2013RU, 9 April, 2013). Retrieved from the Belarusian Institute for Strategic Studies: http://belinstitute.eu/sites/biss.newmediahost.info/files/attached-files/BISS_SA08_2013en.pdf.

Click here to jump back up to article.

Zetterlund, K. (ed.). Pakistan—Consequences of Deteriorating Security in Afghanistan. Stockholm: Swedish Defence Research Agency. Retrieved from: https://www.foi.se/report-search/pdf?fileName=D%3A%5CReportSearch%5CFiles%5C5cd7239f-1b9f-4da5-8098-521809ab469b.pdf.

Zheng, Y. R. (2017, May 24). Eurasia commodity and trade expo coming in August. China Daily. Retrieved from: http://www.chinadaily.com.cn/business/2017-05/24/content_29482798.htm.

Click here to jump back up to article.

Zhu, Z. Q. (2010). China’s New Diplomacy: Rationale, Strategies and Significance. Farnham: Ashgate.

Click here to jump back up to article.

11 In this paper, the core national interests (listed above) that drive China’s foreign policy are reduced to three security concerns. Issues of sovereign-ty and territory are shortened to defence of Chinese borders. Survival of the CPC is redundant, because its survival depends on protecting China’s national interests in the first place. Therefore, protection of the CPC does not form a security concern. Protection of resources and goods necessary for economic development makes up two concerns, securitisation of key resources and access to markets and resources (Zhu, 2010, p. 6). Thus, the drivers of China’s diplomacy can be reduced to three security con-cerns: defence of Chinese borders, securitisation of key resources, and access to markets and resources. China’s approach to foreign policy in Eurasia is to build partnerships that address these security concerns.